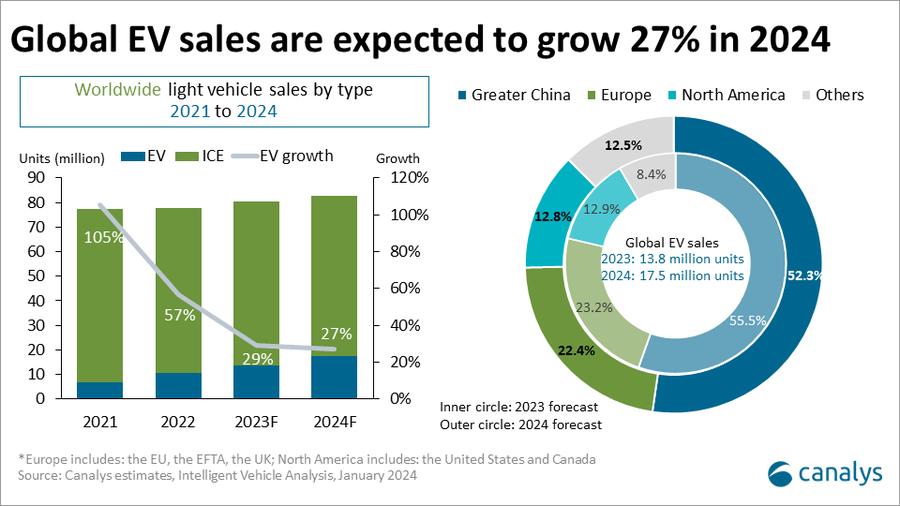

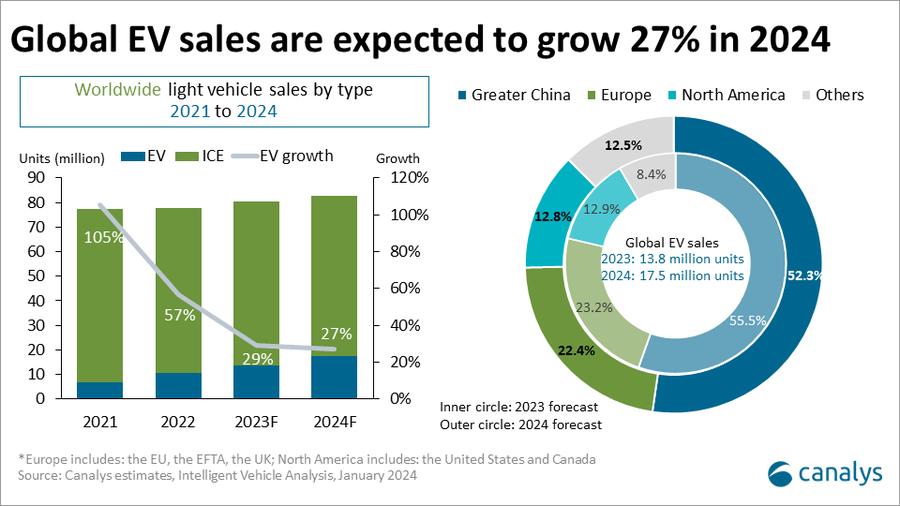

The latest Canalys research predicts sales of global electric vehicles (EVs) to grow 29% and reach 13.7 million units, equating to a penetration rate of 17.1% in 2023. Greater China remains the largest EV market, shipping 7.6 million units with 55.5% market share. Europe, with a shipment of 3.2 million units and North America with a shipment of 1.8 million units will round up the top three markets in 2023. Canalys forecasts the global EV market will grow by 27.1% in 2024, hitting 17.5 million units.

Carmakers are accelerating localization efforts to drive consumer demand by launching region- and market-fit EV models and enhancing the overall EV user experience by developing charging infrastructure and intelligent services ecosystem to support smarter mobility. The general weak cost-effectiveness and subsidy reductions are two significant challenges that carmakers must address to gain stronger growth momentum.

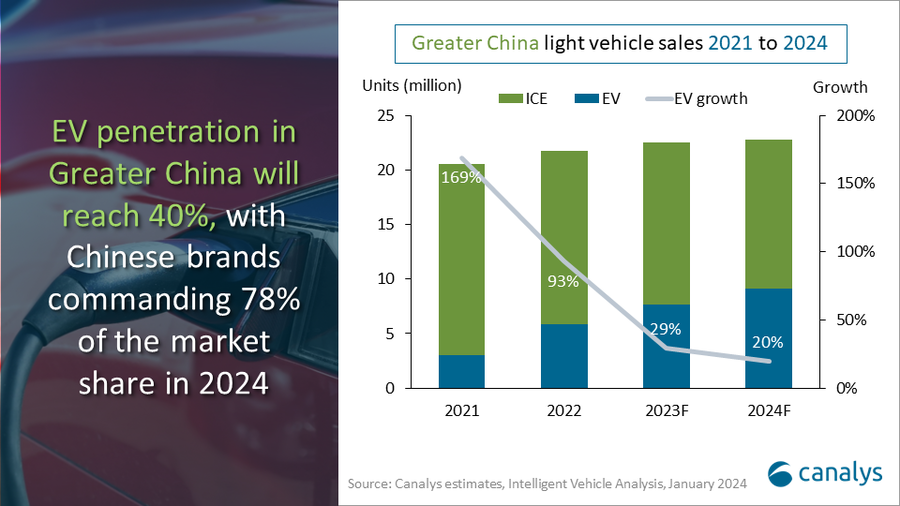

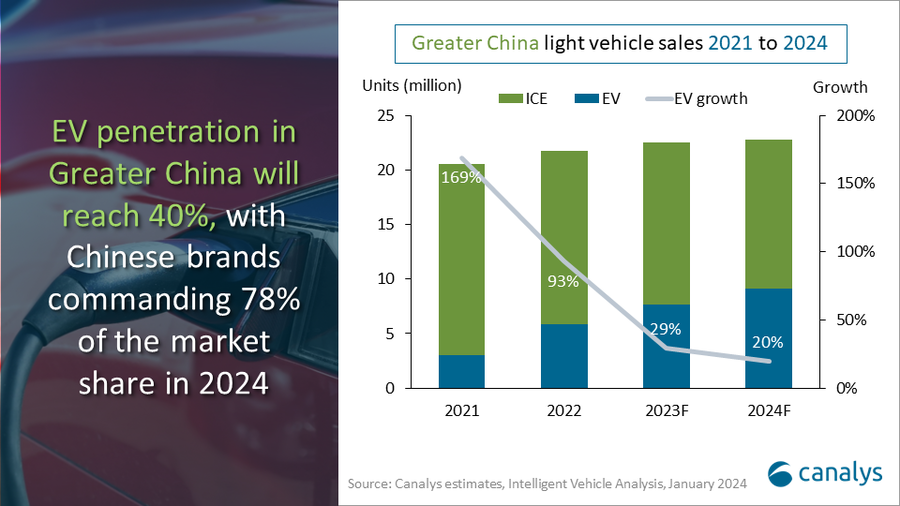

With the government prioritizing sustainable economic development and expanding vehicle consumption, Canalys forecasts light vehicle sales in Greater China to grow 1% to 22.7 million units in 2024. EVs are projected to reach 9.1 million units, taking up 40% of total sales. Drops in battery cost will further drive BEV sales in the compact and subcompact vehicle market. PHEVs will continue gaining market share in the next two to three years due to their cost-effectiveness and stronger adaptability.

“Appealing new EVs were launched at the end of 2023, setting the stage for 2024,” noted Alvin Liu, Analyst at Canalys. “EVs are the core growth driver for the vehicle market in Greater China. EVs from Chinese carmakers, which are expected to take up 78% of the market in 2024, are pulling ahead, widening the user experience gap compared to internal combustion engine (ICE) vehicles. The latest battery technologies and improving infrastructure address charging anxiety. The formation of charging ecosystems, such as NIO’s Battery Swap Alliance, Mercedes-Benz and BMW’s Super Charging Network and Lotus’s Flash Charging Alliance, will further grow BEVs’ market share. However, maintaining a growth rate of over 50% this year is impossible as EVs have reached a critical mass and convincing the remaining EV skeptics will be a growing challenge.”

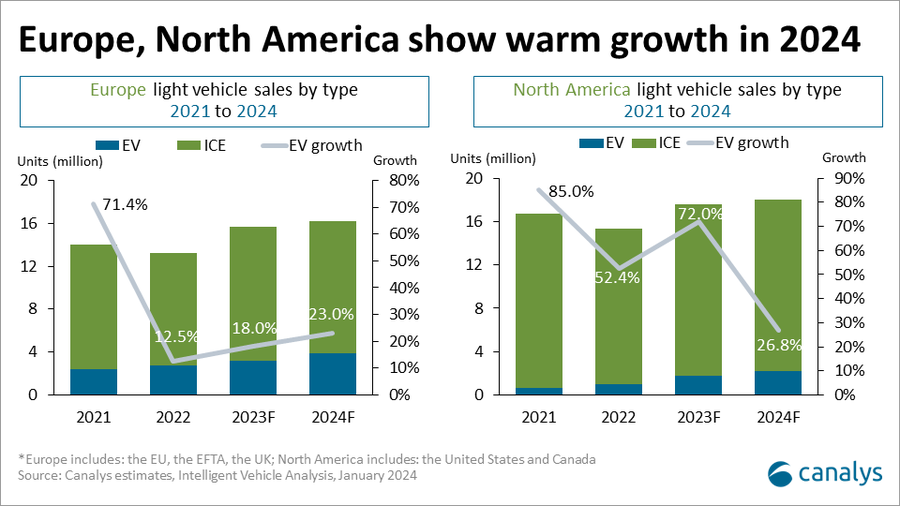

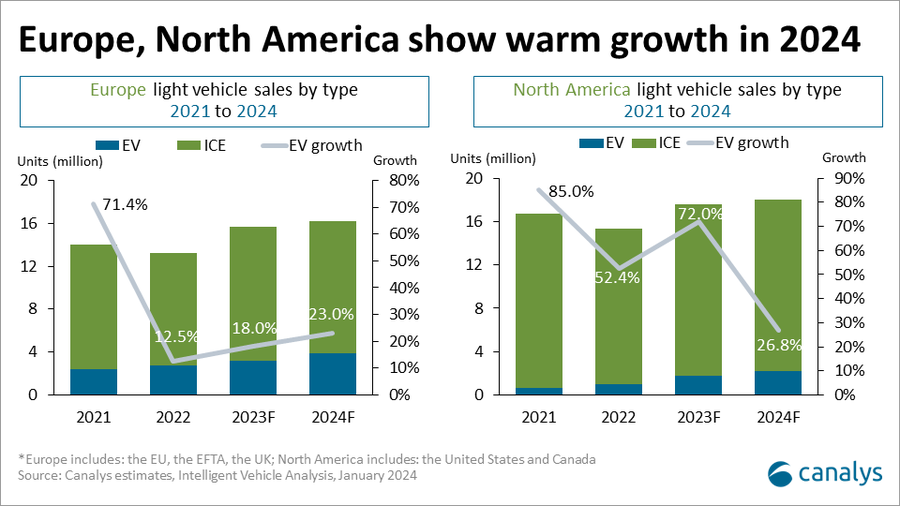

Despite inflation and interest rate hikes, the European light vehicle market is expected to grow 18.6% with a shipment of 15.7 million in 2023, demonstrating Europe’s market resilience post-COVID-related supply issues. The sale of EVs is expected to grow 18%, slightly below the overall light vehicle market, to maintain a market share similar to 2022 at 20.3%, suggesting that Europe is still in the early stage of electrification transformation.

Canalys predicts that the 2024 European light vehicle market will sustain a growth of 2% to 3%, with EVs taking up 24.2% of the market share, shipping 3.9 million units. Amid slowing BEVs demand, a shift to PHEVs can ease market pressures despite the EU’s push for an aggressive combustion engine phase-out. “Europe’s EV market has started transitioning from policy-driven to product-driven in 2024, a necessary phase in the industry’s transformation,” stated Jason Low, Principal Analyst at Canalys. “The subsidy restriction will slow down EV demand and the looming price war will threaten not just EV goals but carmakers’ electric transition confidence. To counter such challenges, carmakers in Europe are set to make the EV market more affordable by releasing new models such as the KIA Niro EV, BMW IX2, Renault 5, Citroen e-C3 and others. European carmakers should be aware of Chinese carmakers eyeing Europe, as they are expected to deploy similar product and pricing strategies while continuing their efforts to establish local production in the region, like that of BYD, SAIC and other positive OEMs.”

EV sales in North America are expected to reach 1.8 million units in 2023, driven by government subsidies and EV charging infrastructure. “Despite a 20% drop in the ASP of EVs in 2023, insufficient product choices and inconvenient charging experience hampered demand, impacting the market growth of EVs,” noted Low.

Canalys predicts that in 2024 the North American EV market will grow 26.8% to 2.2 million units but with the lowest EV penetration at 12.5%, compared to Greater China and Europe. “In 2024, EV product range will expand, covering mini vehicles, full-size SUVs and pickups, effectively broadening EVs’ target user range, supported by a unified charging standard as more OEMs join Tesla's North American Charging Standard (NACS), addressing some of the EV sales obstacles,” commented Low.

Despite challenges to stimulate EV demand in 2024, carmakers will continue to make bets and invest in multiple areas to gain the upper hand in EV technology. Unique factors remain essential in markets such as Greater China. Globally, carmakers need to quickly deploy new EV technologies focusing on cost control and boosting EV user experiences, especially surrounding charging. A solid fundamental will ensure a better position for carmakers to attain more growth in 2025 when EV growth is expected to accelerate. Chinese carmakers will be a force to be reckoned with as they will soon reap the fruits of their global investment in regional manufacturing.

The latest Canalys research predicts sales of global electric vehicles (EVs) to grow 29% and reach 13.7 million units, equating to a penetration rate of 17.1% in 2023. Greater China remains the largest EV market, shipping 7.6 million units with 55.5% market share. Europe, with a shipment of 3.2 million units and North America with a shipment of 1.8 million units will round up the top three markets in 2023. Canalys forecasts the global EV market will grow by 27.1% in 2024, hitting 17.5 million units.

Carmakers are accelerating localization efforts to drive consumer demand by launching region- and market-fit EV models and enhancing the overall EV user experience by developing charging infrastructure and intelligent services ecosystem to support smarter mobility. The general weak cost-effectiveness and subsidy reductions are two significant challenges that carmakers must address to gain stronger growth momentum.

With the government prioritizing sustainable economic development and expanding vehicle consumption, Canalys forecasts light vehicle sales in Greater China to grow 1% to 22.7 million units in 2024. EVs are projected to reach 9.1 million units, taking up 40% of total sales. Drops in battery cost will further drive BEV sales in the compact and subcompact vehicle market. PHEVs will continue gaining market share in the next two to three years due to their cost-effectiveness and stronger adaptability.

“Appealing new EVs were launched at the end of 2023, setting the stage for 2024,” noted Alvin Liu, Analyst at Canalys. “EVs are the core growth driver for the vehicle market in Greater China. EVs from Chinese carmakers, which are expected to take up 78% of the market in 2024, are pulling ahead, widening the user experience gap compared to internal combustion engine (ICE) vehicles. The latest battery technologies and improving infrastructure address charging anxiety. The formation of charging ecosystems, such as NIO’s Battery Swap Alliance, Mercedes-Benz and BMW’s Super Charging Network and Lotus’s Flash Charging Alliance, will further grow BEVs’ market share. However, maintaining a growth rate of over 50% this year is impossible as EVs have reached a critical mass and convincing the remaining EV skeptics will be a growing challenge.”

Despite inflation and interest rate hikes, the European light vehicle market is expected to grow 18.6% with a shipment of 15.7 million in 2023, demonstrating Europe’s market resilience post-COVID-related supply issues. The sale of EVs is expected to grow 18%, slightly below the overall light vehicle market, to maintain a market share similar to 2022 at 20.3%, suggesting that Europe is still in the early stage of electrification transformation.

Canalys predicts that the 2024 European light vehicle market will sustain a growth of 2% to 3%, with EVs taking up 24.2% of the market share, shipping 3.9 million units. Amid slowing BEVs demand, a shift to PHEVs can ease market pressures despite the EU’s push for an aggressive combustion engine phase-out. “Europe’s EV market has started transitioning from policy-driven to product-driven in 2024, a necessary phase in the industry’s transformation,” stated Jason Low, Principal Analyst at Canalys. “The subsidy restriction will slow down EV demand and the looming price war will threaten not just EV goals but carmakers’ electric transition confidence. To counter such challenges, carmakers in Europe are set to make the EV market more affordable by releasing new models such as the KIA Niro EV, BMW IX2, Renault 5, Citroen e-C3 and others. European carmakers should be aware of Chinese carmakers eyeing Europe, as they are expected to deploy similar product and pricing strategies while continuing their efforts to establish local production in the region, like that of BYD, SAIC and other positive OEMs.”

EV sales in North America are expected to reach 1.8 million units in 2023, driven by government subsidies and EV charging infrastructure. “Despite a 20% drop in the ASP of EVs in 2023, insufficient product choices and inconvenient charging experience hampered demand, impacting the market growth of EVs,” noted Low.

Canalys predicts that in 2024 the North American EV market will grow 26.8% to 2.2 million units but with the lowest EV penetration at 12.5%, compared to Greater China and Europe. “In 2024, EV product range will expand, covering mini vehicles, full-size SUVs and pickups, effectively broadening EVs’ target user range, supported by a unified charging standard as more OEMs join Tesla's North American Charging Standard (NACS), addressing some of the EV sales obstacles,” commented Low.

Despite challenges to stimulate EV demand in 2024, carmakers will continue to make bets and invest in multiple areas to gain the upper hand in EV technology. Unique factors remain essential in markets such as Greater China. Globally, carmakers need to quickly deploy new EV technologies focusing on cost control and boosting EV user experiences, especially surrounding charging. A solid fundamental will ensure a better position for carmakers to attain more growth in 2025 when EV growth is expected to accelerate. Chinese carmakers will be a force to be reckoned with as they will soon reap the fruits of their global investment in regional manufacturing.

TEL : +86-132 6020 9406

EMAIL : lee2802@vip.126.com

WECHAT : vivianlee2802

ADD. : No.18 of Jianshe Road, Liangxiang Kaixuan Street, Fangshan District, Beijing,China

QR Code for WeChat